If you’re anything like me, before I started studying insurance, you hear phrases like “bundle and you could save ___” in insurance commercials and it just sounds like another run for your money. But what does this word “bundle” actually mean and is it worth looking into? In today’s economy it might just be worthwhile to start looking at all of our options and trying to save the most money while still getting sufficient coverage.

Bundling your home and auto insurance might just be the solution you’ve been seeking. The definition of bundle is to buy multiple types of insurance policies from the same company. Beyond the convenience of having a single point of contact, bundling offers a range of advantages that can help you save money, enhance your coverage, and streamline your insurance experience.

Let’s delve into the compelling benefits of bundling your home and auto insurance:

1. Significant Cost Savings

Bundling your home and auto insurance can lead to substantial cost savings. Insurance companies often reward policyholders with discounts for bundling multiple policies. These discounts can result in significant reductions in your premiums, putting more money back into your pocket.

2. Simplified Management

Managing multiple insurance policies with different providers can be a logistical challenge. Bundling simplifies your life by consolidating your policies under one insurer. This means a single bill, one renewal date to remember, and a centralized point of contact for all your insurance needs.

3. Enhanced Coverage Options

Bundling can open doors to enhanced coverage options. Insurers often offer additional perks to policyholders who bundle, such as increased coverage limits, added endorsements, or access to umbrella insurance policies. These extras can provide invaluable peace of mind.

4. Improved Claims Experience

In the unfortunate event of a claim, bundling can streamline the process. With all your policies held by one insurer, you’ll have a unified claims experience. This means a smoother claims process, quicker resolutions, and less hassle during already challenging times.

5. Loyalty Rewards

Insurance companies appreciate customer loyalty. Many offer loyalty rewards to customers who bundle and stay with them over the long term. These rewards can include additional discounts, accident forgiveness, or decreasing deductibles, further enhancing the value of your insurance.

6. Comprehensive Protection

By bundling, you’re not only simplifying your insurance experience but also creating a comprehensive safety net. Your home and auto are two of your most valuable assets, and bundling ensures they’re both adequately protected. Plus, with the potential for increased coverage limits, you’re better prepared for unforeseen events.

Bundling your home and auto insurance isn’t just about convenience; it’s a smart financial move. By taking advantage of cost savings, simplified management, and enhanced coverage options, you’re not only protecting your assets but also your financial well-being.

So how do you get started? It’s really quite simple. At Thompson Insurance we make it easy to get in touch with an agent and even get a quote completely electronically. We work with you and your preferred method of communication whether that be face to face or on the phone.

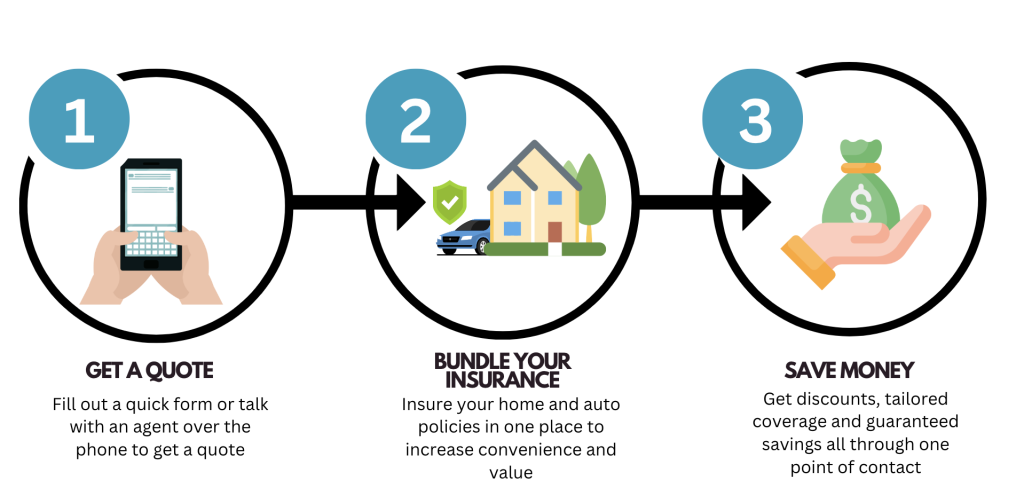

Here’s how to bundle in 3 easy steps: